Whether you’re managing personal finances or running a business, understanding where your money goes is the key to achieving financial control. Tracking and controlling expenses isn’t just about saving more—it’s about making informed decisions, eliminating waste, and building financial confidence.

The process might seem tedious at first, but with the right methods and mindset, expense tracking becomes a powerful habit that helps you take charge of your money. This guide walks you through everything you need to know—from setting up an expense tracking system to making smarter financial choices.

Why Tracking Expenses Matters

You can’t manage what you don’t measure. Expense tracking is the foundation of financial management because it reveals your real spending patterns—not just what you think you spend.

Here’s why it’s essential:

- Increases awareness: You’ll know exactly where your money is going.

- Prevents overspending: Seeing spending habits helps you cut back on unnecessary costs.

- Supports budgeting: A clear record of expenses helps you build realistic budgets.

- Helps achieve goals: You can align your spending with savings or investment targets.

- Reduces stress: Having financial clarity removes uncertainty and anxiety.

Consistent expense tracking helps you take proactive steps toward financial health, rather than reacting when money runs short.

The Basics of Expense Tracking

At its core, expense tracking involves recording every expense, categorizing it, and reviewing the data regularly. Whether you’re a freelancer, a family manager, or a small business owner, the process follows the same structure:

- Record: Write down or digitally capture each transaction.

- Categorize: Group similar expenses together (e.g., rent, food, travel).

- Review: Analyze your spending patterns weekly or monthly.

The goal is to make expense tracking consistent and easy enough to become a natural part of your financial routine.

Choosing the Right Expense Tracking Method

The best method depends on your lifestyle and comfort level. Here are the most effective approaches:

a. Manual Tracking

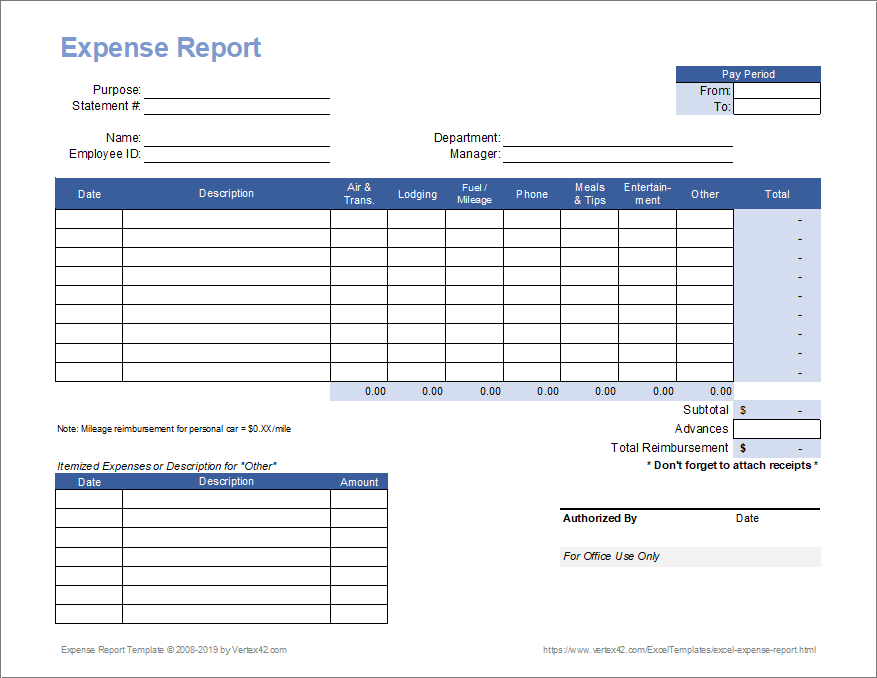

If you prefer control and simplicity, you can track expenses manually using a notebook or spreadsheet. Create columns for the date, description, category, and amount. It’s a hands-on way to stay mindful of every purchase.

b. Spreadsheet Tracking

Using software like Excel or Google Sheets lets you automate calculations and create visual summaries. You can easily sort and analyze spending by category or month.

c. Expense Tracking Apps

For a more automated experience, use apps like Mint, PocketGuard, or YNAB (You Need A Budget). These tools sync with your bank accounts, categorize transactions, and provide real-time insights.

No matter the method, the key to effective expense tracking is consistency. Choose one that fits your routine and stick to it.

Categorizing Expenses for Clarity

Categorization helps transform raw data into meaningful insight. By organizing expenses into logical groups, you can identify patterns and make smarter choices.

Common expense categories include:

- Housing: Rent, mortgage, utilities, insurance

- Transportation: Fuel, car maintenance, public transport

- Food: Groceries, restaurants, coffee shops

- Entertainment: Streaming, hobbies, outings

- Health: Medical bills, fitness memberships

- Savings & Investments: Contributions to future goals

Customizing categories makes your expense tracking system more relevant to your personal or business needs.

How to Control Expenses Effectively

Tracking expenses is the first step; controlling them is where transformation happens. Here’s how you can regain control over your spending habits:

a. Set Spending Limits

Once you know your spending categories, assign realistic limits to each. Stick to these limits as closely as possible.

b. Identify Unnecessary Costs

Review your expenses regularly to find patterns—like unused subscriptions, frequent takeout, or impulse shopping. Cutting these saves a surprising amount of money.

c. Automate Savings

Treat saving as a non-negotiable expense. Set up automatic transfers to a savings account each month.

d. Prioritize Needs Over Wants

Differentiate between essentials and non-essentials. If it doesn’t contribute to your well-being or business growth, reconsider the purchase.

e. Use Cash or Debit for Discretionary Spending

Limiting yourself to a set amount in cash helps prevent overspending.

With discipline and ongoing expense tracking, these steps become second nature.

Expense Tracking for Businesses

For small business owners and freelancers, expense tracking is not only about budgeting—it’s a compliance and profitability tool.

- Keep Receipts and Invoices: Store all documents digitally for easy access during audits.

- Track Tax-Deductible Expenses: Record business-related purchases like office supplies, software, and travel to maximize deductions.

- Separate Business and Personal Finances: Use different bank accounts to avoid confusion.

- Review Reports Quarterly: Regular reviews help identify cost-saving opportunities and improve cash flow.

When you maintain clear records, you make tax season easier and gain better control over profit margins.

Tools to Simplify Expense Tracking

Technology can make financial management effortless. Here are a few reliable tools worth exploring:

- Mint: Great for personal finance management with real-time insights.

- QuickBooks: Ideal for small businesses and freelancers.

- Expensify: Streamlines receipt tracking and reimbursement processes.

- Notion or Google Sheets: Flexible tools for custom expense tracking systems.

Using automation reduces manual work and helps you focus on what matters—analyzing results and improving your financial habits.

Review, Reflect, and Adjust

Tracking expenses is not a one-time task—it’s a continuous cycle of review and adjustment. At the end of each month:

- Evaluate whether you stayed within budget.

- Identify where you overspent and why.

- Adjust your goals and categories for the next month.

The more you practice expense tracking, the more control you gain over your finances. You’ll notice patterns, anticipate costs, and make confident money decisions.

Building Strong Financial Habits

Expense tracking is just the foundation. To build long-term success:

- Schedule a weekly “money check-in.”

- Celebrate milestones—like saving a set amount or cutting unnecessary costs.

- Keep learning about budgeting, investing, and personal finance.

Over time, these habits compound into lasting financial stability and freedom.

Conclusion

Mastering your money starts with awareness. When you implement consistent expense tracking and take control of your spending, you empower yourself to make better decisions, save more, and reach your financial goals faster.

By combining technology, discipline, and regular reviews, you’ll transform expense tracking from a chore into a powerful tool for financial success. Remember: small, consistent actions today lead to lasting control tomorrow.

Leave a Reply