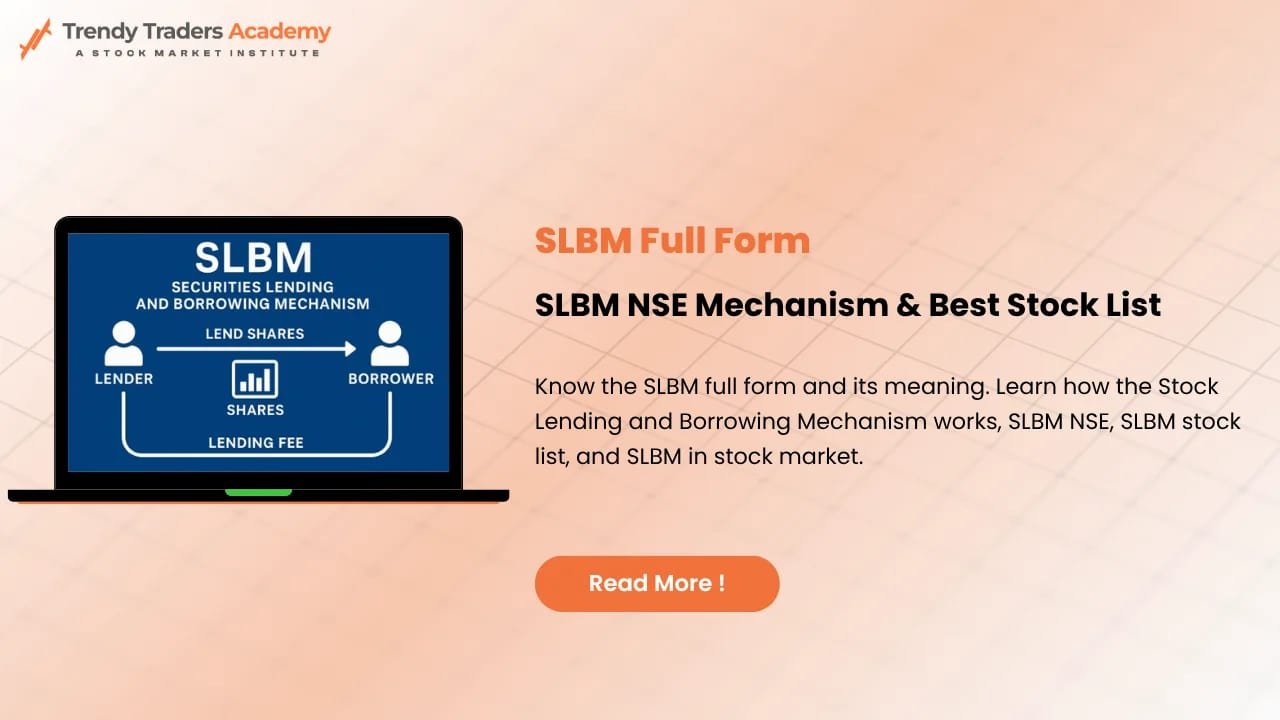

SLBM Full Form: SLBM NSE Mechanism & Best Stock List Guide

If you’ve ever wondered what the SLBM in stock market really means or how traders use it to boost their profit potential, you’re in the right place. In this beginner-friendly guide, we’ll break down the SLBM full form, explain how the SLBM mechanism works on NSE, share a practical slbm stock list, and even help you find the best trading course in India to build long-term trading skills.

Think of this guide as your “Google Maps” for navigating the SLBM world—you’ll know where it starts, how it moves, and how you can use it confidently.

Learn SLBM full form, SLBM mechanism, SLBM in stock market & slbm stock list. Beginner-friendly guide plus best trading course in India.

Introduction to SLBM

The stock market isn’t just about buying low and selling high—it’s a full ecosystem with tools designed to help traders express their market view. SLBM, one of these tools, is often misunderstood but extremely powerful when used correctly.

Before jumping deep, let’s simplify everything step-by-step so even a beginner feels at home.

What Is the SLBM Full Form?

SLBM stands for Securities Lending and Borrowing Mechanism.

It is a regulated system in India that allows traders to borrow shares temporarily for trading purposes—mainly for short selling.

Imagine borrowing your friend’s bike with the promise to return it later. That’s exactly what SLBM is—except here, what’s borrowed are stocks.

Why Was the SLBM System Introduced?

SEBI introduced SLBM to:

- Support short selling in a regulated way

- Reduce settlement issues by ensuring share availability

- Improve liquidity in the stock market

- Protect investors through transparent borrowing rules

Before SLBM, short selling had many risks. With SLBM, everything runs like a disciplined library system—borrow, use, and return on time.

SLBM in Stock Market: A Simple Breakdown

SLBM allows traders to:

- Borrow shares

- Sell them in the market

- Buy back later

- Return to the lender

This is commonly used when traders expect stock prices to fall. They sell borrowed shares first and buy them back cheaper later, making the difference as profit.

How the SLBM Mechanism Works on NSE

Let’s break the SLBM mechanism into simple steps:

Step 1: Borrowing the Shares

A trader requests to borrow shares through the exchange-approved platform.

Step 2: The Trade Happens

The trader receives the shares and sells them in the open market.

Step 3: Repurchasing (Square-off)

The trader buys back the same number of shares—preferably at a lower price.

Step 4: Returning to the Lender

Shares are returned, and the contract closes.

It’s smooth, transparent, and fully controlled by the exchange—no shady backdoor deals.

Key Participants in the SLBM Process

SLBM isn’t a one-person show. It includes:

- Borrowers – Traders who borrow shares

- Lenders – Investors willing to lend idle shares

- Clearing corporations – NSE Clearing Ltd ensures settlement

- Brokers – Act as facilitators

This ecosystem guarantees safety, just like how an airport functions with pilots, ATC, ground staff, and passengers.

Tenure & Categories Under SLBM

There are multiple contract durations available:

- 1 month

- 3 months

- 6 months

- Up to 12 months

These give traders flexibility depending on their strategy.

Benefits of SLBM for Traders

Here’s why SLBM is becoming increasingly popular:

✔ Enables Short Selling Safely

Traders can take advantage of expected price falls.

✔ Provides Passive Income for Lenders

Long-term investors earn lending fees.

✔ Maintains Market Stability

Helps avoid delivery failures during settlement.

✔ Supports Advanced Trading Strategies

Pairs well with F&O, hedging, and arbitrage.

Risks Involved in SLBM

Like any tool, SLBM carries risks:

- Price risk – Shares may rise instead of fall

- Borrowing cost – Fees could reduce profits

- Liquidity risk – Not all stocks are available to borrow

- Square-off pressure – Must return shares on time

However, careful risk management reduces most of these issues.

SLBM Stock List: Popular & Frequently Borrowed Stocks

Although the exact list keeps changing, here are types of stocks often found in an SLBM stock list:

Highly Liquid Stocks

- Reliance Industries

- HDFC Bank

- ICICI Bank

- Infosys

- TCS

Popular Midcaps

- Deepak Nitrite

- Tata Power

- Bharat Forge

High-beta Stocks

- Adani Enterprises

- Zee Entertainment

- RBL Bank

These stocks are chosen because of liquidity, volatility, and trading volumes.

SLBM vs Intraday Trading

| SLBM | Intraday |

| Can carry forward short positions | Must close same day |

| Low liquidity risk | High volatility risk |

| Ideal for positional shorting | Ideal for day scalping |

SLBM gives more breathing space compared to the fast-paced intraday environment.

SLBM vs F&O Trading

Many traders confuse the two. Here’s the comparison:

| SLBM | F&O |

| Borrow actual shares | Trade contracts |

| Lower leverage | High leverage |

| No expiry stress | Strict expiry cycles |

| Safer for beginners | Risky without experience |

Use SLBM when you want simplicity; use F&O when you want flexibility (and can handle the heat).

Charges Involved in SLBM

Common costs include:

- Borrowing fee – Paid to the lender

- Brokerage charges

- Exchange fees

- Taxes & statutory charges

Always calculate potential profit after deducting borrowing fees.

Best Strategies to Use SLBM

Here are some effective approaches:

a) Shorting Before Quarterly Results

If you expect weak performance, SLBM lets you hold the short position beyond intraday.

b) Hedging Long Positions

Use SLBM to hedge portfolio risks temporarily.

c) Arbitrage Opportunities

Exploit price differences between spot and futures using borrowed shares.

d) Long-Term Positional Shorts

Combine SLBM and technical analysis for extended bearish cycles.

Best Trading Course in India to Master SLBM

Choosing the best trading course in India can dramatically improve your understanding of SLBM and advanced trading concepts.

Look for courses that provide:

- SLBM training

- F&O strategies

- Technical analysis

- Risk management modules

- Live market sessions

Platforms like Zerodha Varsity, FinGrad, and premium private institutes offer excellent structured learning.

Conclusion

SLBM is a powerful tool for both traders and long-term investors. Whether you want to short a stock for weeks or earn through lending idle shares, the SLBM mechanism offers transparency, safety, and flexibility. With the right knowledge—and maybe the best trading course in India—anyone can start using SLBM confidently.

FAQs

1. What is the full form of SLBM?

SLBM stands for Securities Lending and Borrowing Mechanism.

2. What is SLBM in the stock market used for?

It allows traders to borrow shares, mainly for short selling or hedging.

3. Is SLBM safe for beginners?

Yes, it is regulated by SEBI and NSE, making it secure for beginners with proper guidance.

4. How long can I borrow shares under SLBM?

You can borrow for 1 month to 12 months, depending on contract availability.

5. Which stocks are available in the SLBM stock list?

Liquid and high-volume stocks like Reliance, HDFC Bank, TCS, and many midcaps are commonly available.

Leave a Reply