The Buy Now Pay Later (BNPL) model is one of the most profound changes that have brought a revolution to the consumer relationship with money since the fintech revolution. This is a transparent system of flexible payment whereby users can buy merchandise immediately and pay it later in the form of interest-free payments. Buy Now Pay Later App Development is turning out to be prioritized among the top priorities of both fintech startups and businesses as a critical requirement at the time when the demand in convenience and accessibility of digital credit and financing continues to rise.

The Evolution of Payment Flexibility

Banks and financial institutions have traditionally controlled the traditional credit systems. Nevertheless, digital consumers of the new generation want alternatives that are faster, frictionless, and transparent. BNPL apps are seizing that void by offering instant buying power and easing the process of repayment.

This has increased with the emerging use of eCommerce and mobile banking. Buy Now Pay Later App Development solution is an emerging solution that retailers, tech innovators, and payment gateways are implementing into their systems to increase user engagement and improve the conversion rate. It is not only the evolution in terms of providing flexible payments, but it is a wider change towards digital financial empowerment.

Driving Technology behind BNPL Platforms.

The current BNPL applications have a high-tech framework that is created on a performance, security, and scalability basis. These applications are based on AI-based risk processing, cloud-based computing, and sophisticated encryptions at the core.

Instant approvals and personalized repayment plans are made possible by the AI and machine learning models that analyze the creditworthiness of a user in real-time. In the meantime, microservice architecture enables developers to process various modules, such as payments, authentication, and analytics, separately so that they can be scaled smoothly.

Third Party API Integration is also important in connectivity to payment processors, credit bureaus and merchant networks by the developers. This interoperability is responsible to ensure smooth transactions and real-time notifications, as well as, increased fraud detection across platforms.

The User Experience of the BNPL Ecosystem.

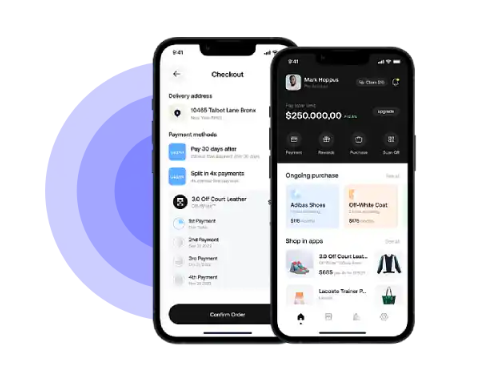

The development of an intuitive secure user experience is a highly significant factor in the success of a BNPL platform. The interface is expected to be user-friendly and simple to navigate as the users will be able to handle their purchases, see repayment schedules and make payments in a couple of seconds.

In Buy Now Pay Later App Development, the developers apply the principles of adaptive designs in order to render apps responsive to the devices. Biometric authentication, digital wallets, and push notifications are some of the features that can assist users to manage their finances effectively. The personalization through AI brings an additional sophistication, suggesting specific payment methods and buying notifications based on the analysis of the behavior.

Lifecycle Approach of the BNPL App Development.

The design of the BNPL app that ensures high performance is a result of the mobile app life cycle: ideation and prototyping, testing and constant improvement. In the early MVP stage of the app development, developers are interested in such basic functionality as loan management, user verification, and integration of a payment gateway.

After the MVP is confirmed in the market testing, developers proceed to testing user interface, improve performance, and smart credit management systems. This cyclical process makes sure that every edition of the app is in accordance with the changing expectations of customers and industry requirements.

The mobile app maintenance service is necessary after launch. There are constant updates, bug fixes, and compliance modifications that would make the functionality of the product smooth and stable in the long term. The maintenance stage also enables the inclusion of the emerging technologies which are blockchain, real-time analytics, and AI-driven security models.

The implementation of APIs in Smarter Financial Operations.

Third Party API Integration is an important factor that allows the flexibility and intelligence of a BNPL platform. The APIs enable the application to interact with other fundamental external providers, including payment gateways (such as Stripe or PayPal), online shopping platforms (such as Shopify or WooCommerce), credit rating services.

Other features that the developers can integrate through APIs include transaction history, invoice generation, and real-time calculation of interest. The integrations shorten the development time, enhance the reliability of the apps and provide a smooth experience to both the users and the merchants.

Moreover, open banking API can optimize transparency because users can safely connect their financial accounts to assess credit instantly and make automatic payments, which will be the core of digital payments in the future.

BNPL Systems Security and Compliance.

Security is the foundation of Buy Now Pay Later App Development. All data transfers and transactions have to be run in accordance with international financial regulations including PSD2, GDPR, and PCI DSS. Multi-layer encryption and tokenization, as well as artificial intelligence (AI)-based fraud detection, are some of the ways through which developers protect sensitive financial data.

Conformity is also important. The BNPL ecosystem functions on several jurisdictions, each of which has local lending and data protection laws. Therefore, regulatory automation tools and compliance APIs are combined to make sure that they are adhered to, without human supervision. Such security with automation enhances trust between the user and business credibility.

Predictive Analytics and AI in BNPL Solutions.

AI has been applied not just to credit-score, but it forms the basis of contemporary fintech decisions. Predictive analytics in Buy Now Pay Later App Development enables firms to know how users spend, default, and model an adaptive payment scheme.

Data visualization and real-time insights will enable developers to monitor KPIs like the repayment rates, the volumes of transactions, and the measures of engagement. This factual provision makes the platforms competitive and keeps on upgrading on the basis of market conduct.

In the near future, AI will take a significant part in hyper-personalization- it will provide individual users with personalized financial products, rewards, and loyalty schemes.

The Role of a Comprehensive App Development Solution

With startups and already established financial brands, it is important to collaborate with a professional app development solutions provider. Expert developers are not only responsible for writing codes, they also undertake integration, development of architecture, testing and compliance processes.

An experienced team will make sure that all layers, such as payment processing and analytics, are optimized in terms of performance and user satisfaction. Through agile practices, developers are able to respond to changes occurring in the market in a short period of time, and maintain the quality of their products and innovation.

The Future of Online Payments via BNPL.

This need of quick and versatile payment will increase as the global eCommerce will continue to grow. BNPL applications will become a part of digital wallets, virtual cards, and AI-based lending models to establish one digital finance ecosystem.

Innovations in the future will be the use of blockchain-supported transactions to enhance the transparency of transactions, biometric payments to promote security, real-time settlement systems that use smart contracts. Such technological innovations will further open the BNPL solutions to even more accessible, inclusive, and secure to people all over the world.

Conclusion

The Buy Now Pay Later App Development is transforming the consumer-merchant relationship in terms of their financial transaction. Combining smart credit, AI, and real-time analytics, BNPL platforms are closing the convenience-financial responsibility gap.

Developers are building future-proof fintech ecosystems through scalable, high-quality mobile app life cycle processes, seamless Third Party API Integration, and mobile app maintenance service.

At a time when immediate gratification and digital innovation are matched together, BNPL solutions are not only transforming the payment process, but changing the whole financial experience of the modern connected world.

Leave a Reply