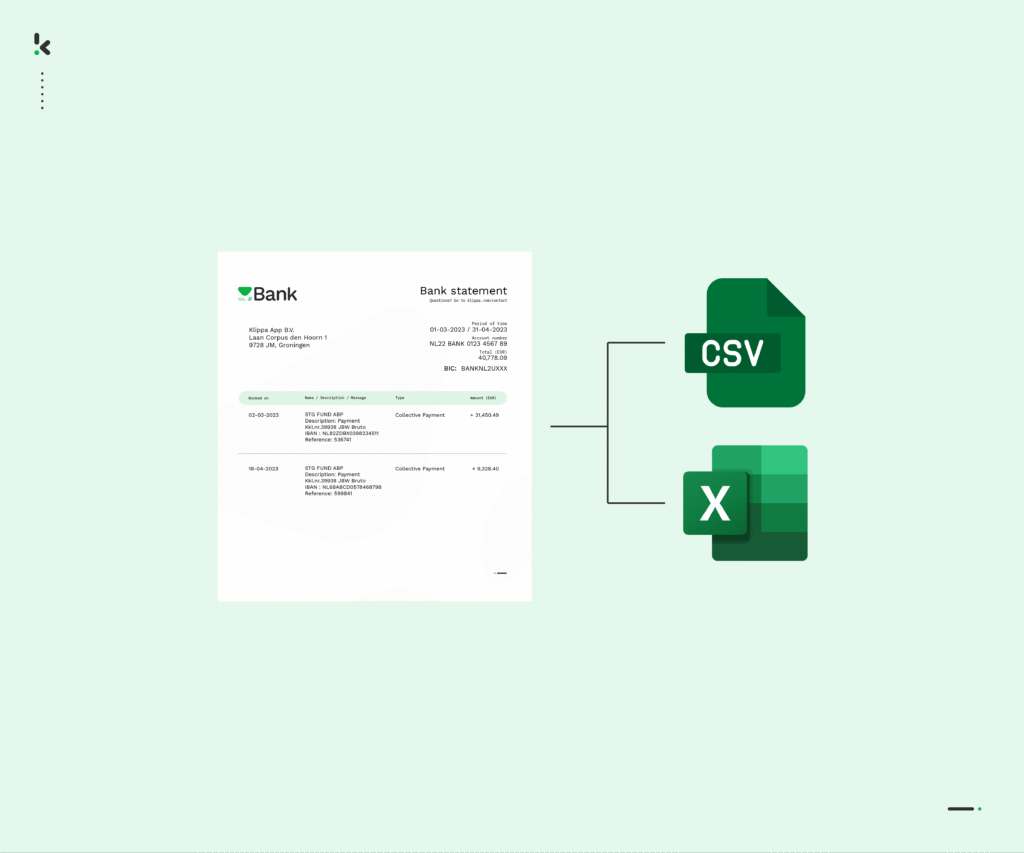

Handling financial data requires both accuracy and security. Many individuals and businesses need a reliable method to turn PDF or scanned bank statements into a format that can be analyzed and organized easily. Converting a bank statement to excel is a common necessity, but not every tool or process guarantees safety and accuracy. That is where solutions such as Bank Statement Converter come into play, offering users a structured and secure way to transform raw statements into usable data while ensuring minimal risk of errors.

Understanding the Importance of Conversion

Financial records stored in PDF or paper format are not always practical for analysis. When data remains locked in static files, users spend valuable time copying figures manually or trying to interpret large amounts of information without proper tools. By converting statements into Excel, businesses and individuals can sort, filter, and evaluate transactions in a much more efficient manner. This process is not just about convenience; it is about creating a system where decision-making becomes data-driven and financial management gains transparency.

Security Concerns in Financial Data Management

When dealing with sensitive financial data, security cannot be overlooked. Bank statements often contain personal details, account balances, and transaction histories. If mishandled, this information can be exposed to unauthorized parties. Using unverified or free online tools may pose risks such as data leaks, malware, or unauthorized storage of private financial details. Therefore, safety must be prioritized when selecting a method for conversion. A safe process ensures that data remains confidential and is only accessible to the rightful owner.

Methods of Converting Bank Statements

There are multiple ways to convert financial documents into Excel. Some users opt for manual entry, while others rely on automated tools. Manual methods, though sometimes necessary for small sets of data, are prone to errors and time-consuming. Automated conversion tools are much faster and reduce the risk of human mistakes. Among these, specialized software offers the advantage of accuracy, security, and efficiency, which is essential for professionals and organizations that depend on reliable records.

Key Features of Safe Conversion Tools

Choosing a secure method to handle financial documents requires attention to features that protect user data. Trusted solutions generally provide several safeguards:

- Encrypted data handling to protect sensitive information

- High accuracy in converting numbers and text without formatting loss

- Compatibility with different formats including scanned PDFs

- No hidden storage or external data sharing

These features ensure that users can confidently process their financial records without compromising confidentiality.

By relying on these safeguards, users can achieve both efficiency and peace of mind when converting bank statements into Excel.

Why Excel is the Preferred Format

Excel remains the most widely used software for financial analysis, reporting, and data management. It allows users to organize transactions in chronological order, categorize expenses, and prepare financial summaries. Unlike PDF files, Excel supports formulas, charts, and pivot tables that make in-depth analysis possible. For accountants, business owners, and individuals who want clarity in their financial position, Excel offers unmatched flexibility and control.

Advantages of Using Professional Conversion Solutions

Professional services and tools designed specifically for statement conversion reduce both risk and effort. They provide accurate extraction of transaction details such as dates, amounts, and descriptions, ensuring that no information is lost. Furthermore, they support bulk processing, which saves time for businesses that need to process multiple months of records. Instead of relying on generic converters, specialized tools deliver tailored features that handle financial data with the care it requires.

Common Challenges in Conversion

Not all conversion methods are perfect. Some PDF files may contain scanned images rather than digital text, making extraction difficult. Poor-quality scans, non-standard formatting, and inconsistent layouts can cause inaccuracies in output files. Users often encounter misplaced numbers, broken columns, or incomplete transaction data. Choosing the right tool reduces these challenges by applying advanced recognition technology that can interpret a wide range of formats.

Best Practices for Safe Conversion

To ensure the safest approach when converting financial records, users should adopt clear practices. Always choose verified tools or trusted software providers. Avoid free online platforms that do not provide data privacy guarantees. Keep all original documents securely stored in case a reference is needed. Regularly update any software used to ensure compatibility with the latest formats and to maintain security standards. Businesses should also train staff handling such data on secure processes to minimize human error.

Practical Applications After Conversion

Once bank statements are successfully converted to Excel, they can be used for multiple purposes. Individuals can track spending habits, prepare personal budgets, and analyze income trends. Businesses can monitor cash flow, reconcile transactions, and prepare financial reports for internal or external review. Accountants can streamline audit processes by having access to clean, structured data. Overall, Excel provides a platform where raw data transforms into actionable financial insights.

The Role of Bank Statement Converter

Bank Statement Converter offers a specialized approach to handling this process with accuracy and security. Instead of relying on manual input or risky online platforms, users gain access to a tool designed to maintain data integrity throughout the conversion. Its functionality ensures that financial records are transferred into Excel in an organized format, ready for further analysis without compromising security. This makes it a dependable option for individuals, professionals, and organizations seeking both safety and efficiency.

Conclusion

The safest way to convert financial records lies in selecting reliable tools and following secure practices. While many methods exist, not all guarantee accuracy or data protection. Converting a bank statement to excel is most effective when carried out through specialized, secure solutions such as those provided by Bank Statement Converter. This approach ensures that users gain both convenience and peace of mind, knowing their sensitive financial information is protected while remaining fully functional for analysis and reporting.

FAQs

Why is Excel better than PDF for financial data?

Excel allows users to analyze, sort, and filter data, which is not possible with static PDF files. It also supports formulas and charts for deeper insights.

Can scanned bank statements be converted into Excel?

Yes, with the right tool that supports optical character recognition (OCR), scanned statements can be accurately converted into Excel format.

Is it safe to use free online converters for bank statements?

Free tools often lack proper encryption and may pose data security risks. It is safer to use trusted software designed for secure financial data handling.

What should I check before choosing a converter?

Users should look for encryption, accuracy, compatibility with multiple formats, and clear privacy policies that protect sensitive data.

How does Bank Statement Converter ensure accuracy?

It uses advanced recognition technology to extract transaction details correctly, minimizing errors and formatting issues that occur in generic tools.

Leave a Reply