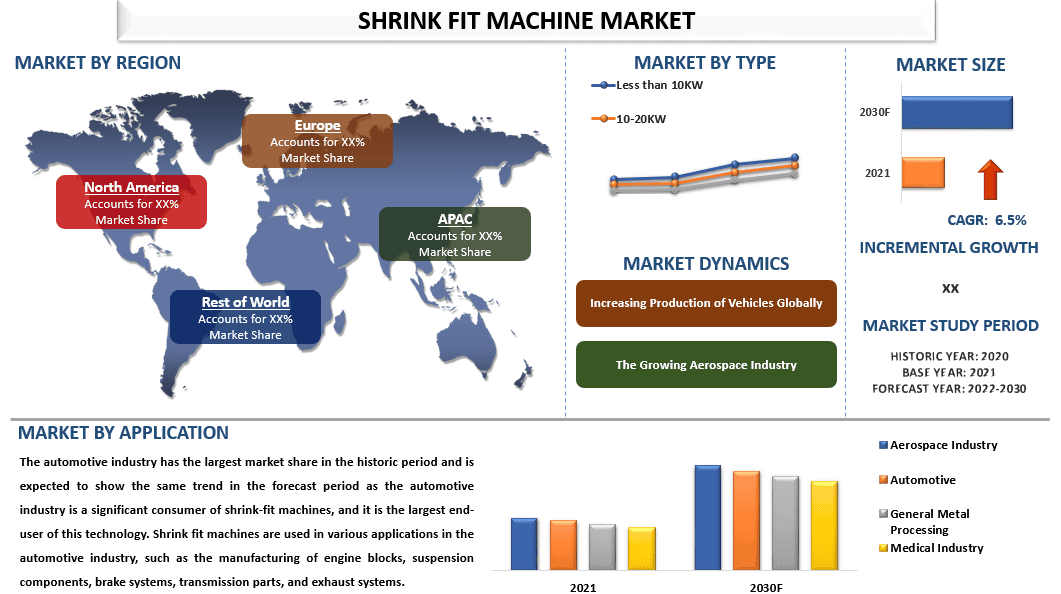

The Shrink Fit Machine Market is projected to register a robust CAGR of approximately 6.50% over the forecast period, fueled by the rising need for high-precision machining across the manufacturing sector.

Asia-Pacific Expected to Lead with Highest Growth

The Asia-Pacific region is anticipated to post the fastest CAGR from 2022 to 2030, largely due to the rapid expansion of the automotive industry in recent years. This region includes major economies such as China, India, Japan, and South Korea, which have well-developed technological infrastructure and house leading automotive and industrial machinery manufacturers—Maruti Suzuki, BYD, Toyota, Hyundai, among others—producing both internal combustion engine (ICE) vehicles and electric vehicles (EVs), thereby creating substantial demand for shrink-fit machines.

According to a September 2022 International Energy Agency (IEA) report, the EV market share in China rose from 5% in 2020 to 16% in 2021. Supportive government initiatives in India, China, and Japan have been instrumental in accelerating growth in the shrink-fit machine market, particularly for automotive and aerospace applications, where precision metal components are essential.

In India, defense and aerospace remain key industrial pillars, bolstered by Make in India initiatives and regulatory focus on advanced technology adoption. This has significantly strengthened domestic manufacturing capacity.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/shrink-fit-machine-market?popup=report-enquiry

Strong Opportunities in Defense & Aerospace

The Indian Ministry of Defense has set a target of 70% self-reliance in weapon production by 2027, opening substantial avenues for industry players. Data from 80 companies shows FDI inflows of over USD 463.55 million into the defense and aerospace sector as of June 2020.

India’s competitive advantage lies in low-cost manufacturing, affordable labor, abundant resources, and favorable policy frameworks, offering considerable growth potential in aerospace manufacturing. With these advantages, alongside government-backed initiatives, the demand for shrink-fit machines in India is expected to climb sharply in the years ahead.

Asia-Pacific’s Accelerated Market Outlook

Overall, the Asia-Pacific shrink-fit machine market is forecast to expand strongly during 2022–2030. The region’s fast-growing automotive sector—particularly the transformation in China and India toward higher vehicle production (both gasoline-powered and battery-operated)—is pushing manufacturers to adopt technologies for lightweight vehicle production, boosting demand for shrink-fit machines.

Government-driven Industry 4.0 programs are further accelerating technology adoption across manufacturing, reinforcing market growth.

Market Segmentation by Type

- Less than 10 kW

- 10–20 kW

- More than 20 kW

The more than 20 kW segment held the leading position historically and is expected to maintain dominance throughout the forecast period. High adoption rates in aerospace, automotive, and manufacturing industries stem from these machines’ ability to handle heavy-duty workloads. Their faster heating and cooling cycles improve throughput—critical for high-volume production—while maintaining accuracy and repeatability.

For instance, Indian Brand Equity Foundation (IBEF) projected in December 2020 that the Indian aerospace & defense market would reach nearly USD 70 billion by 2030, driven by infrastructure upgrades and strong government support—factors that reinforce demand for high-power (>20 kW) shrink-fit machines.

Market Segmentation by Application

- Aerospace Industry

- Automotive

- General Metal Processing

- Medical Industry

The automotive sector remains the largest consumer of shrink-fit machines, both historically and in projections. These machines are critical for producing engine blocks, suspension components, braking systems, transmission parts, and exhaust systems.

Market growth is closely tied to rising demand for lightweight, high-performance vehicles and the global shift toward EV adoption. With volatile fuel prices and stringent emission regulations, EV production requires lightweight yet strong specialized components—which shrink-fit machines manufacture efficiently.

According to the IEA, global consumer spending on EVs reached USD 120 billion in 2020, up 50% from 2019, driven by a 41% increase in sales and a 6% rise in average prices. The U.S. Bureau of Labor Statistics reported that EVs in the U.S. grew from 22,000 units in 2011 to over 2 million by 2021. This upward trend directly benefits shrink-fit machine adoption in automotive manufacturing.

Click here to view the Report Description & TOC: https://univdatos.com/reports/shrink-fit-machine-market

Global Shrink Fit Machine Market Segmentation

By Type

- Less than 10 kW

- 10–20 kW

- More than 20 kW

By Application

- Aerospace Industry

- Automotive

- General Metal Processing

- Medical Industry

By Region

- North America: U.S., Canada, Mexico, Rest of North America

- Europe: Germany, UK, France, Italy, Spain, Rest of Europe

- Asia-Pacific (APAC): China, Japan, India, South Korea, Rest of APAC

- Rest of the World

Key Market Players

- Haimer GmbH

- BILZ WERKZEUGFABRIK GmbH & Co. KG

- Guhring, Inc.

- Diebold

- MST Corporation

- Zoller

- Lyndex-Nikken

- Falcon Toolings

- Kelch GmbH

- D’ANDREA S.p.A.

Contact Us:

UnivDatos

Contact Number – +1 978 733 0253

Email – contact@univdatos.com

Website – www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

Leave a Reply