Introduction

Financial statement analysis is a cornerstone of business decision-making, providing crucial insights into an organization’s financial health. Traditionally, this process has been time-consuming, requiring extensive manual work to interpret financial data from income statements, balance sheets, and cash flow reports. However, the rise of artificial intelligence (AI) and machine learning (ML) has dramatically transformed financial analysis, leading to the development of AI-powered financial statement analyzer that streamline and enhance accuracy in financial reporting.

By leveraging AI and ML algorithms, businesses, investors, and financial institutions can automate financial data interpretation, reduce human errors, and make data-driven decisions with greater confidence. This article explores the impact of AI-powered financial statement analyzers, their benefits, challenges, and the future of AI-driven financial analysis.

The Evolution of Financial Statement Analysis

Traditional Methods vs. AI-Powered Solutions

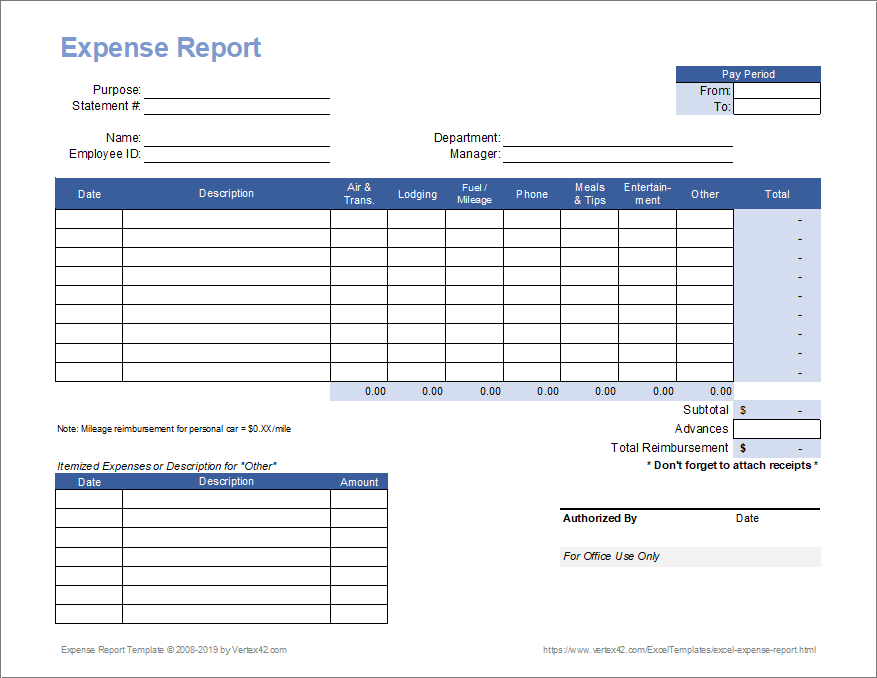

Historically, financial statement analysis relied on manual calculations, spreadsheet models, and financial ratios to evaluate a company’s performance. Analysts would review reports line by line, identifying trends and discrepancies that could indicate financial health or risks. While effective, these traditional methods were:

- Prone to human error

- Time-intensive

- Limited in predictive capability

- Inconsistent in large-scale data processing

With the introduction of AI-powered financial statement analyzers, the financial industry is undergoing a paradigm shift. These AI-driven tools utilize ML algorithms to extract and analyze financial data, identify anomalies, and generate real-time insights with minimal human intervention.

How Machine Learning is Transforming Financial Insights

1. Automated Data Processing and Analysis

AI-powered financial statement analyzers can automatically extract financial data from structured and unstructured sources, such as PDFs, Excel sheets, and ERP systems. Machine learning algorithms standardize and categorize this data, eliminating the need for manual entry and reducing errors.

2. Enhanced Accuracy and Fraud Detection

One of the most significant advantages of AI-driven financial analysis is its ability to detect fraud and financial discrepancies. Traditional audits rely on sampling techniques, which may overlook irregularities. In contrast, ML-powered financial statement analyzers scan entire datasets, identifying:

- Unusual transactions

- Duplicate entries

- Inconsistencies in financial reports

- Potential compliance violations

By utilizing anomaly detection techniques, AI can flag suspicious activities before they escalate into significant financial issues.

3. Predictive Analytics for Better Decision-Making

AI-based financial statement analyzers leverage historical data to predict future financial performance. Machine learning models analyze past trends and external factors (such as market conditions and economic indicators) to forecast revenue, profitability, and risk exposure. These predictive insights empower businesses to:

- Make informed investment decisions

- Optimize cash flow management

- Anticipate market fluctuations

- Adjust financial strategies proactively

4. Real-Time Financial Reporting and Insights

Traditional financial reporting often lags due to manual data collection and processing. AI eliminates these delays by offering real-time financial insights. AI-powered dashboards provide instant access to key performance indicators (KPIs), financial ratios, and comparative analyses, allowing businesses to make timely and strategic decisions.

5. Sentiment Analysis and Market Trends

Beyond numerical data, AI-powered financial statement analyzers integrate natural language processing (NLP) to assess sentiment in financial news, earnings reports, and social media discussions. By analyzing qualitative data, businesses can:

- Gauge market sentiment

- Understand investor perception

- Identify emerging risks and opportunities

This additional layer of analysis provides a holistic view of a company’s financial standing beyond traditional reports.

Benefits of AI-Powered Financial Statement Analyzers

1. Increased Efficiency

AI automates repetitive tasks, significantly reducing the time required for financial analysis. Businesses can allocate resources to strategic planning rather than manual data processing.

2. Cost Savings

By minimizing human intervention, AI-driven financial analysis reduces labor costs associated with manual data entry and auditing. It also prevents financial losses by identifying risks early.

3. Improved Decision-Making

AI-generated insights enable CFOs, investors, and analysts to make data-driven decisions quickly. Accurate forecasts help companies optimize budgets, investments, and financial strategies.

4. Scalability

AI-powered financial analysis can handle large datasets without compromising speed or accuracy. This makes it ideal for multinational corporations, financial institutions, and investment firms dealing with vast financial records.

5. Regulatory Compliance

Regulatory bodies impose strict financial reporting standards, and AI-powered financial statement analyzers help organizations comply with regulations such as IFRS, GAAP, and SEC reporting requirements. Automated compliance checks reduce the risk of penalties and legal issues.

Challenges and Limitations of AI in Financial Analysis

1. Data Quality and Integration Issues

AI models rely on high-quality, structured data for accurate analysis. Poor data quality, missing values, and incompatible formats can impact results. Integrating AI-powered financial analyzers with existing accounting software and databases remains a challenge for many organizations.

2. Interpretability and Transparency

While AI offers advanced insights, its decision-making processes are often opaque. Financial analysts and regulators require transparency in AI models to ensure accountability and trust in automated financial analysis.

3. Cybersecurity Risks

AI systems are vulnerable to cyber threats, including data breaches and algorithmic manipulation. Organizations must implement robust cybersecurity measures to protect financial data from unauthorized access.

4. Regulatory Uncertainty

The rapid advancement of AI in financial analysis has outpaced regulatory frameworks. Governments and financial authorities are still developing guidelines for AI-driven financial reporting, leading to uncertainties in compliance requirements.

The Future of AI-Powered Financial Statement Analysis

The adoption of AI-powered financial statement analyzers is expected to grow significantly in the coming years. Several key trends will shape the future of financial analysis:

1. Integration with Blockchain Technology

Blockchain-based financial reporting ensures data integrity and prevents tampering. AI and blockchain integration will enhance transparency and trust in financial data analysis.

2. AI-Augmented Human Expertise

AI will not replace financial analysts but will augment their capabilities. Financial professionals will use AI-powered tools to interpret insights, identify opportunities, and develop strategic financial plans.

3. Personalized Financial Insights

AI will enable customized financial analysis tailored to individual businesses, investors, and stakeholders, providing personalized recommendations based on unique financial goals.

4. Voice-Activated Financial Analysis

With advancements in voice recognition technology, AI-powered financial statement analyzers may offer voice-based interactions, allowing executives to request financial insights through smart assistants.

5. Greater Adoption by SMEs and Startups

As AI-powered financial tools become more accessible and affordable, small and medium-sized enterprises (SMEs) will increasingly adopt AI for financial analysis, improving their competitiveness in the market.

Conclusion

AI-powered financial statement analyzers are revolutionizing the way businesses interpret financial data. By automating data processing, enhancing accuracy, and providing predictive insights, AI is transforming financial decision-making. While challenges such as data quality, transparency, and regulatory concerns remain, ongoing advancements in AI and machine learning will continue to refine and expand the capabilities of financial statement analysis. As businesses and financial institutions embrace AI-driven tools, the future of financial analysis promises greater efficiency, accuracy, and strategic intelligence.

Leave a Reply